It provides a structured method to confirm that amounts recorded in the accounts align with actual transactions undertaken. This is vital for effective financial management and accurate financial reporting. The final step is to take appropriate actions to resolve the cost issues and prevent them from recurring in the future. The budget bond market vs stock market: key differences should also be updated to reflect the actual costs and the expected costs for the remaining period or scope of the project or activity. For example, if the cost of materials is expected to remain high for the rest of the project, the budget should be increased accordingly or the scope or quality of the project should be reduced.

Step 3 of 3

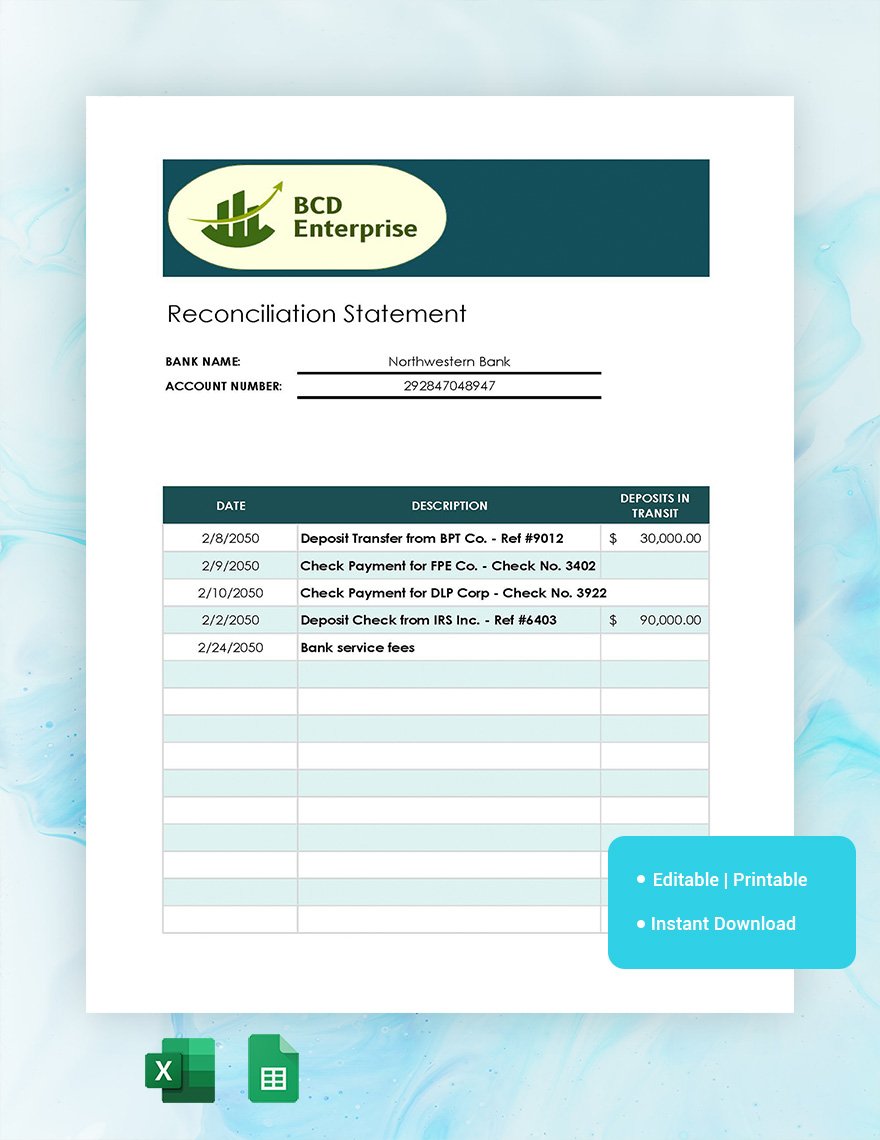

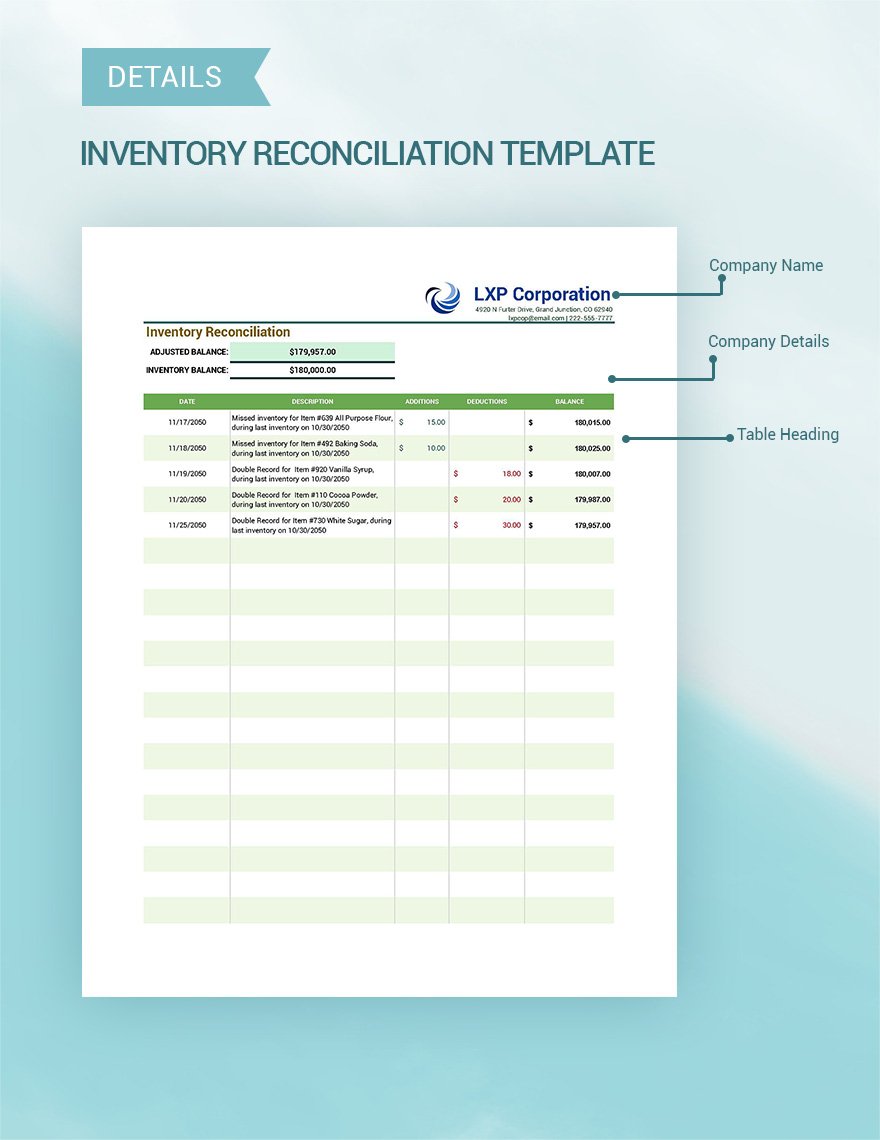

This schedule computes the cost of goods transferred out (based on the number of units transferred out times the cost per equivalent unit calculated in Part 3) plus the cost of WIP inventory remaining in the department at the end of the month. If the indirect method is used, the cash flow from the operations section is already presented as a reconciliation of the three financial statements. Other reconciliations turn non-GAAP measures, such as earnings before interest, taxes, depreciation, and amortization (EBITDA), into their GAAP-approved counterparts. In accounting, reconciliation refers to the process of comparing two sets of records or financial information, such as bank statements, general ledger accounts, or other relevant records, to ensure their accuracy and consistency.

What Is Cost Value Reconciliation (CVR) In Construction?

By following these steps, the project team can optimize the cost reconciliation process and ensure that the project cost is verified and resolved in a timely, accurate, and effective manner. This can help improve the project cost management and delivery, and enhance the project quality and value for the client. The final step is to report and communicate the results of the cost reconciliation to the relevant parties, such as the project team, the management, the client, the sponsor, the auditor, etc. The report should summarize the findings and conclusions of the cost reconciliation and provide supporting evidence and documentation. The report should also highlight any issues or risks that may affect the project or process and suggest ways to mitigate or resolve them. The report should also include any feedback or suggestions for improving the cost reconciliation process or the project or process itself.

How to Prepare Part 4 of a Cost of Production Report

Some of the common causes of cost variances are changes in the market prices, changes in the quantity or quality of the inputs, changes in the production methods or efficiency, errors in the estimation or allocation of the costs, etc. For example, the cost variance of materials could be due to an increase in the price of the raw materials, a change in the supplier, a change in the specifications or quality standards, a mistake in the ordering or delivery process, etc. Now that we have figured out how many equivalent units of production via each method, let’s apply the costs. Costs consist of raw materials, direct labor and overhead for each item produced. Sometimes, a great deal of the raw materials have already been put into a product, but it still needs a chunk of labor to move it to the next department.

Variances between expected and actual amounts are called “cash-over-short.” This variance account is kept and reconciled as part of the company’s income statement. These different types of reconciliation are important for maintaining accurate financial records, detecting errors and fraud, and ensuring the reliability of the accounting system. They give organizations a clear and accurate picture of their financial position, which enables them to make informed business decisions. We’ll cover best practices and strategies that organizations can use to streamline their reconciliation processes, minimize errors, and establish a solid foundation for financial management.

- Overall, management assesses the efficiency of the Company’s E&P field operations by considering core E&P operating expenses together with cogeneration, marketing and transportation activities.

- By examining cost accounts, financial transactions are compared and evaluated.

- One of the most important steps in cost reconciliation is analyzing the cost components of a project or process.

- This is another useful way of analyzing cost components, especially for long-term or complex projects or processes that involve multiple stages or parts.

- Having timely access to such suitable adjusted data sources can also provide other benefits.

Not only does it boost the accuracy of cost and financial reports, but with an integrated accounting system, mistakes can be prevented from the source itself. Automated reconciliation also reduces costs and inefficiencies while minimizing human error on financial tasks. This improved process will save time and money by eliminating the need for manual reconciliations of cost accounts while providing key insights into your financial health in real-time. Having access to a diverse set of data sources is essential for any organization. If the actual costs are higher than the baseline budget, project managers need to identify the reasons for the cost increase and take corrective measures, such as reducing costs or increasing efficiency. RIB Candy is a versatile estimating, planning, and project control solution perfectly suited to the complexity and scope of construction CVR.

Ascertain the basis on which stocks of raw materials, work-in-progress, and finished goods have been valued for balance sheet purposes, and then compare it with the valuations in the cost accounts. Prepare a schedule of all expenses and losses included in the trading and profit and loss account but not in cost accounts. A cost accountant maintains cost accounts as per the principles of cost accounting to ascertain the total and per-unit cost of products and jobs at different stages of production or execution. The non-integral system sees cost accounts and financial accounts maintained separately. When calculating the equivalent units with the weighted average method and the FIFO method we will end up with a different quantity, using the same data.

We will continue the discussion under the weighted average method and calculate a cost per equivalent unit. By embedding these practices into the organizational fabric, companies can demystify the intricacies of cost reconciliation and uphold the veracity of their financial statements. Through diligent application of these principles, the veil of complexity is lifted, revealing a clear path to fiscal accuracy and reliability. Frequent reviews of financial records allow for timely identification of inconsistencies. A monthly reconciliation of expenses in a retail business can prevent the accumulation of errors and simplify year-end audits.