Discrepancies can occur due to various reasons, such as errors, fraud, waste, inefficiency, or external factors. Investigating discrepancies can help identify the root causes of the problems and provide solutions to prevent or minimize them in the future. In this section, we will discuss how to conduct a root cause analysis for cost discrepancies and what are some of the best practices and tools to use. One of the most important steps in cost reconciliation is implementing controls that can prevent future cost discrepancies from occurring. Cost discrepancies can arise due to various factors, such as human errors, inaccurate estimates, changes in scope, fraud, or external events.

What is Cost Value Reconciliation? Reviewing the Principles and Best Practices Behind It

- In addition, reconciliations can identify errors or improper recording of financial transactions while helping identify areas of opportunity to improve efficiency and reduce costs.

- In this section, we will discuss how to reconcile costs from different perspectives, such as the project manager, the accountant, the auditor, and the stakeholder.

- A construction firm could use project management software that integrates cost tracking, making reconciliation more efficient and reducing human error.

This is a crucial part of cost reconciliation, as it ensures that the actual cost matches the expected cost and that the project or process is delivered within the budget and the quality standards. Taking corrective actions involves analyzing the impact of the inconsistencies, evaluating the alternatives, choosing the best option, implementing the changes, and monitoring the results. In this section, we will discuss these steps in detail and provide some examples of how to take corrective actions for different types of inconsistencies. The next step is to compare the actual costs incurred with the expected costs budgeted or estimated for the project or process. The comparison can be done at different levels of detail, such as by category, by period, by activity, by task, by resource, etc.

Reconciling Your Report: The Final Steps

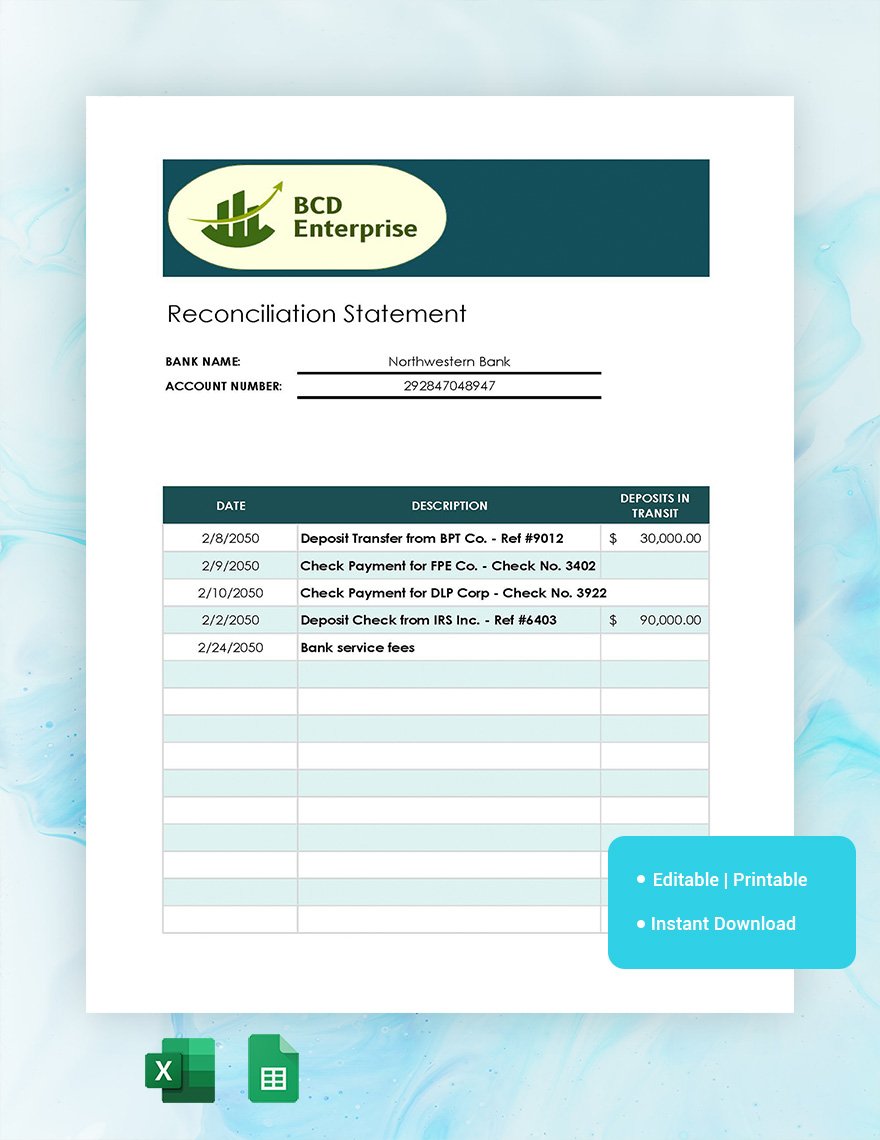

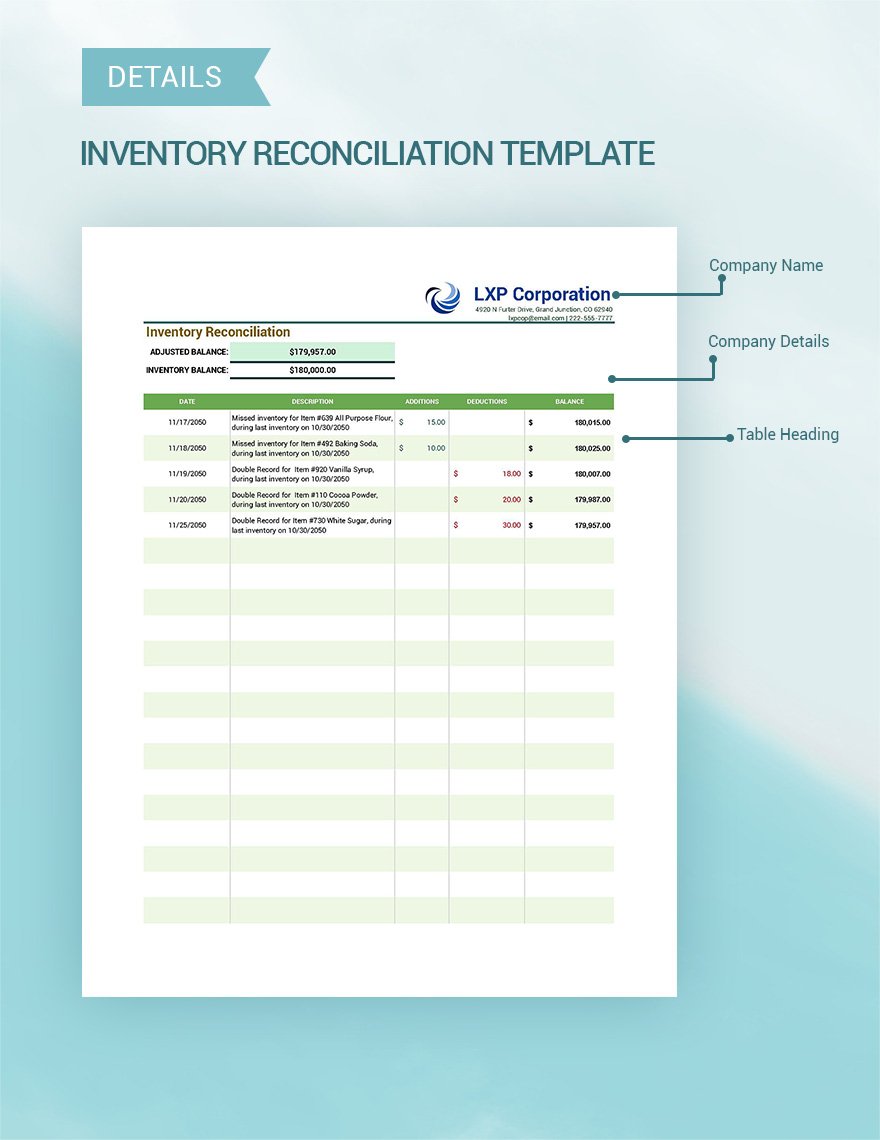

It is a crucial step in cost accounting that ensures the accurate reporting of production costs and the efficient management of resources. A Cost Accounting Reconciliation Statement is a vital tool used to reconcile costs between financial and cost accounting. This statement helps identify discrepancies between the two accounting systems, ensuring the accuracy of financial data. By the best accounts receivable financing options uncovering these differences, businesses can maintain accurate records and enhance decision-making processes. Adjusted Net Income (Loss) excludes the impact of unusual and infrequent items affecting earnings that vary widely and unpredictably, including non-cash items such as derivative gains and losses. This measure is used by management when comparing results period over period.

Advantages of CVR

The problem will provide the information related to beginning work in process inventory costs and units. We calculated total equivalent units of 11,000 units for materials and 9,800 for conversion. We’ve covered a lot of ground in creating a reconciliation report in Excel.

The cost reconciliation report for this project would state that the project was over budget by $20,000 and provide the reasons and recommendations for each cost category. The report would also indicate the impact of the cost overrun on the project’s profitability and cash flow and suggest ways to improve the cost management and control for future projects. The third step is to analyze and explain the variances or differences between the actual and expected costs and their impact on the project or process. The analysis should identify the root causes of the variances, such as errors, omissions, delays, overruns, underestimates, overestimates, etc. The analysis should also quantify the magnitude and significance of the variances, such as favorable or unfavorable, material or immaterial, controllable or uncontrollable, etc.

Revenue and Finance Automation

For example, if the inconsistency is due to a miscommunication between the team members, the corrective action may be to clarify, confirm, or update the information and the expectations. The third step is to select the most suitable solution based on the criteria and the constraints of the project or process. This may involve weighing the pros and cons, ranking the options, or using a decision-making tool or technique. The chosen option should be aligned with the project or process objectives, requirements, and expectations. For example, if the inconsistency is due to a defect in the product, the best option may be to repair, replace, or refund the product depending on the severity of the defect and the customer satisfaction. This can lead to frustration within the business as financial statements do not accurately reflect the organization’s finances.

This may involve brainstorming, researching, consulting, or testing different options. The alternatives should be evaluated based on their feasibility, effectiveness, cost, time, and quality. For example, if the inconsistency is due to a delay in the delivery of a material, the alternatives may include ordering from another supplier, substituting with a different material, or rescheduling the project activities. Under the non-integral system of accounting, which maintains cost accounts and financial accounts separately, the documents used to ascertain the amount of charged expenditure are the same. Since both cost and financial accounts are maintained independently and have different purposes and accounting procedures, the profit or loss shown may also differ. Thus, reconciliation identifies and accounts for the items which have led to the difference in working results as shown by cost accounts and financial accounts.

This alignment, often referred to as cost reconciliation, serves as a critical checkpoint in financial management, ensuring that every dollar spent is accounted for and justified. It’s a complex dance of numbers and categories, where precision is paramount. The third step is to analyze the reasons behind the cost variances and explain them in detail.

The variances should be calculated and expressed in both absolute and percentage terms, and should be classified as favorable or unfavorable. The reasons for the variances should be identified and explained, such as changes in prices, volumes, efficiency, or quality. Reconciliation is an accounting process used to compare both financial accounts to ensure their costs match up. Reconciliation example involves comparing the cost accounts of two different sources. Consistently gathering your cost data across multiple sources into one accessible place creates a valuable view of your operation’s broader financial picture.

The following table presents a reconciliation of the GAAP financial measure of general and administrative expenses to the non-GAAP financial measure of Adjusted General and Administrative Expenses for each of the periods indicated. For a discussion and presentation of Adjusted Free Cash Flow for the prior period, see our previous filings with the SEC. Free Cash Flow is not necessarily a measure of our ability to fund our cash needs.